How to use MiFinity in online casinos

Online casino cashiers accept plenty of payment methods, and MiFinity is, without a doubt, one of the more popular ones. This e-wallet launched in 2016 and has since seen a steady increase in popularity with gamblers worldwide.

Over the years, MiFinity has established close ties to the online gambling industry, with a growing number of platform providers adding this payment service to their Banking sections. In this guide, you can learn everything you need to know about how it works and how to get started.

Pros and cons of MiFinity

Using MiFinity offers many benefits to people looking to gamble for real money online.

- MiFinity delivers a safe experience. The e-wallet secures all transactions with SSL technology. That way, players don't have to worry about the safety and security of their personal information and banking details.

- The provider also uses Strong Customer Authentication (SCA), in line with the new European requirement known as the Payment Services Directive (PSD2). This technology aims to prevent fraud and further increases overall security by using two-step verification for login.

- Once the money is in your wallet, MiFinity won't charge any fees for making online casino deposits. It means you won't have to pay double charges, and you'll be able to use every penny or cent you deposit. While you'll still encounter certain fees, MiFinity is reasonably priced compared to other e-wallets.

- Another advantage of MiFinity is the payment method's wide global availability. You can use the e-wallet across the globe, with the exception of a few countries where this option is not available. MiFinity currently accepts 42 local payment options in Europe and Latin America, in addition to 11 settlement currencies.

- MiFinity also supports a wide range of cryptocurrencies, such as Bitcoin, Litecoin, and Ethereum.

However, it's not all sunshine and roses. MiFinity has certain downsides, which you have to keep in mind.

- MiFinity includes high exchange rates, which is something you have to consider when carrying out a transaction involving currency conversion.

- All MiFinity transactions incur fees charged by the payment service provider.

MiFinity fees

MiFinity online casinos generally don't charge fees for depositing and withdrawing using this payment method. However, the service provider includes fees for transactions made to feed your e-wallet or when you cash out money.

Payment and withdrawal fees vary depending on your payment method and country, so be careful when making a choice. For instance, topping up your e-wallet with Visa incurs fees from 1.8% to 3.5%. The only exception are SEPA bank transfer deposits that are free of charge. As for withdrawals, withdrawing funds in cryptocurrencies is subject to a 1.8% fee. Check the MiFinity fees page for all details.

Keep in mind that any currency conversion comes with exchange rates. In that case, you'll have to pay a fee of 2.99% to the wholesale exchange rate. The fee is applied immediately, even without prior notification. When it comes to cashing out, the good news is that using MiFinity for withdrawing is cheap.

Create a MiFinity account: a quick guide

Using MiFinity is not complicated and setting up a new account shouldn't take long. If you wish to use the popular e-wallet, here's what you need to do:

- Visit the MiFinity website and click the Sign Up button.

- Enter your email address, create and confirm your password, and agree to the Terms & Conditions and Privacy Policy by ticking the corresponding box.

- To set up your account, click Create Account. You'll then receive an activation email containing a link you must click to complete the registration.

- Open the activation email and click on the link. You'll be redirected to the Login page. To access your MiFinity account, enter your username and password.

- Once you've logged into your account, create your MiFinity e-wallet by entering your personal information, category, and preferred currency.

- You'll also be prompted to pick security questions and answers to use when accessing your MiFinity e-wallet.

- You will have to provide a verification code to open your MiFinity e-wallet. This code will be sent to the phone number you entered during the registration.

The activation of your base account can take some time, as there's a chance you won't receive your activation link immediately. The same goes for your MiFinity e-wallet. To verify it, you'll need to prove your identity and address. It means you'll need an ID card, passport, driver's license, or any other document. It may take up to 48 hours to complete the KYC procedure.

Depositing in a MiFinity casino

To start using the MiFinity e-wallet, you'll need to open a new online casino account. Once that's taken care of, you're ready to make your first deposit.

Log into your online casino account and go to the banking page. Click to make a deposit and choose MiFinity from the list of available payment options.

The next step is to enter the details of your MiFinity account to link your e-wallet. After that, choose the amount you wish to deposit. You'll receive a message confirming the transaction and the money should be available in a matter of seconds.

Cashing out in a MiFinity casino

If an online casino accepts MiFinity as a deposit option, it will probably allow players to also use the service for withdrawing their funds. Normally the method used for your latest deposit will automatically be chosen for your withdrawal too. The process is similar to depositing, enabling players to easily make their withdrawal requests.

To request a withdrawal, go to the casino's Cashier section and click "Withdrawal" or "Cashout". After entering the amount of money you wish to grab, you can select MiFinity as your preferred banking solution if this is not done automatically. You'll then be redirected to a new window where you can log into your MiFinity account. Log in and verify the transaction and the withdrawal will be processed.

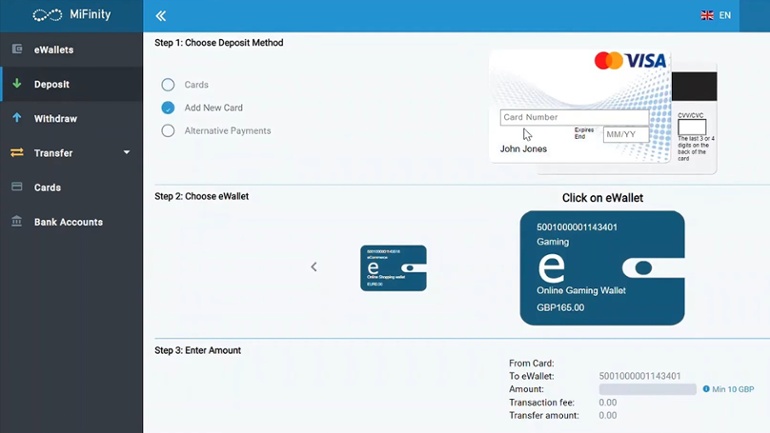

Adding and removing funds from your MiFinity account

Adding and removing funds from the MiFinity e-wallet is relatively simple. There's more than one way to add funds to MiFinity. You can use the Deposit option from the menu, or select the MiFinity account you want to fund and pick the Deposit option. You can choose different methods, such as bank cards (MasterCard, Visa, UnionPay) and alternative payments (including local payment methods and cryptos like Bitcoin and Bitcoin Cash).

In case you want to use local payment options, you will have to complete online transfers with your bank. All you have to do is choose your method and follow the on-screen instructions.

If you're using a bank card, the name on the card and the one of the MiFinity account holder must match. Please get in touch with Client Services via email to delete or add new cards. Keep in mind that you can't use a business bank account with MiFinity.

Finally, if you used a card to add funds to your account and completed the verification process, you'll be able to send money back to that card. To do so, choose "Withdraw" from the available options. Select the e-wallet you want to cash out money from. Enter the amount of money you want to withdraw, and then click on the Make Payment option. You will receive a confirmation email with the credentials of your transaction.