Investing vs Gambling: Are They Really So Different?

The legendary investor Warren Buffett once compared the stock market to a 'great big casino', referring to the hordes of investors willing to risk money in the hope of getting rich.

The comparison is a common topic in financial discussion. Buffett isn't the only expert to make it, with some using it as a way to criticise risky leveraged investments and Contracts for Differences (CFDs).

Yet if we look up the meaning of the two words, we see a fundamental difference. The Merriam Webster dictionary defines them as follows:

Right away, there's a key distinction. The purest meaning of investing, according to this, is to expect profit, whereas the same dictionary focuses on the risky nature of gambling, suggesting a loss.

So, why do so many people conflate the two? Should investing and gambling really be put into the same bracket?

In this article, we're going to look at the comparison of investing to gambling and apply the knowledge of experts from the two fields to see if it has any merit.

From an investment perspective, we've asked PhD finance professors and expert investors their thoughts, and from the gambling side, we will contribute our specialist knowledge of the betting process.

The aim is to come up with a detailed answer as to whether the investing vs gambling analogy is valid, while exposing a few myths in the process.

What investing and gambling have in common

To start, let's dig deeper into the traits that the two activities share to understand why people make these comparisons.

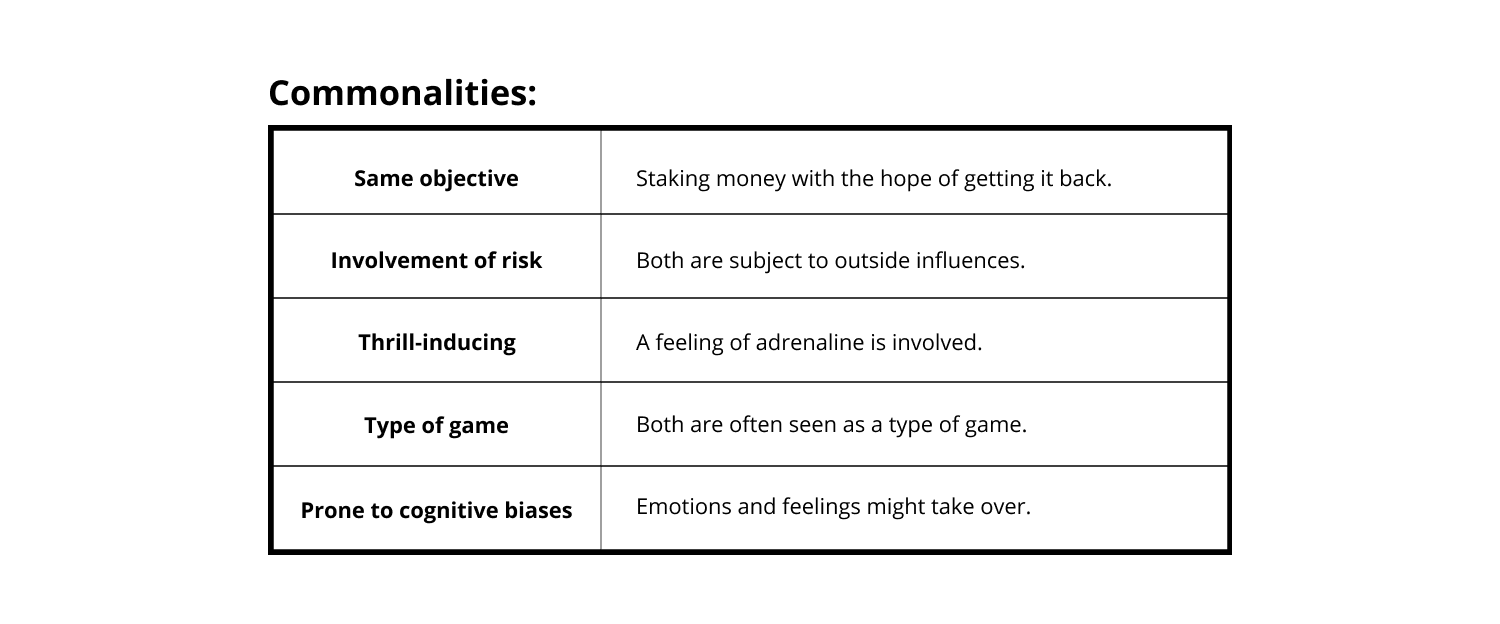

Both involve staking money with the hope of getting it back

If we strip the two activities down to the core, we can see that they share the same objective. We stake money, whether on a bet or an investment, in the hope that we get more of it back. We also know that we could lose our money should things not go our way.

In fact, thinking of your investments as "money lost" is a good strategy. That way, you can make sure to always invest only money you can afford to lose. However, it's the hope of making back more than we've staked/invested that fuels the next similarity.

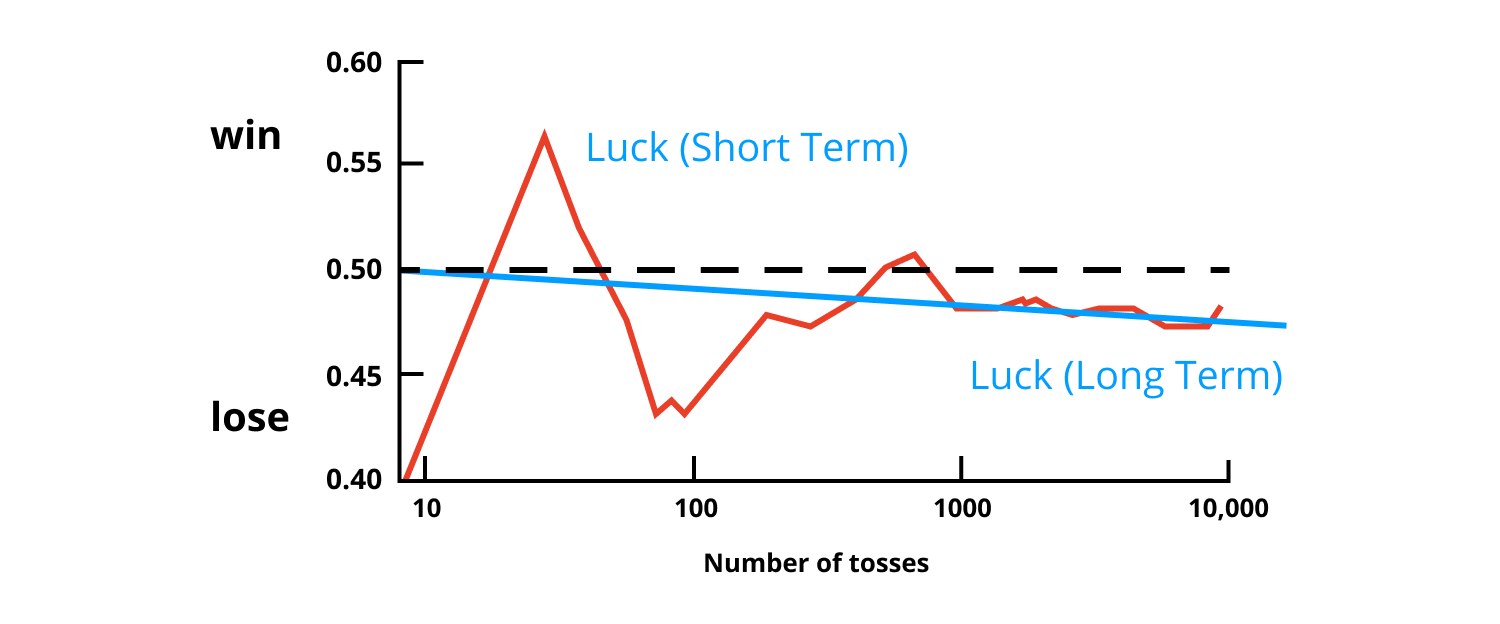

Both are subject to risk

The most crucial shared element of all: risk. Without a crystal ball to see into the future, every investment is a gamble to some extent.

Outside influences, which we have no control over, fuel this risk as they can affect the outcomes in either of the two activities.

In gambling, this outside influence is chance. In slot games, the result is determined by a random number generator which makes the outcome impossible to predict.

When playing card games such as blackjack, strategies like card counting can theoretically get the odds to the player's side, but casinos fight hard against this practice.

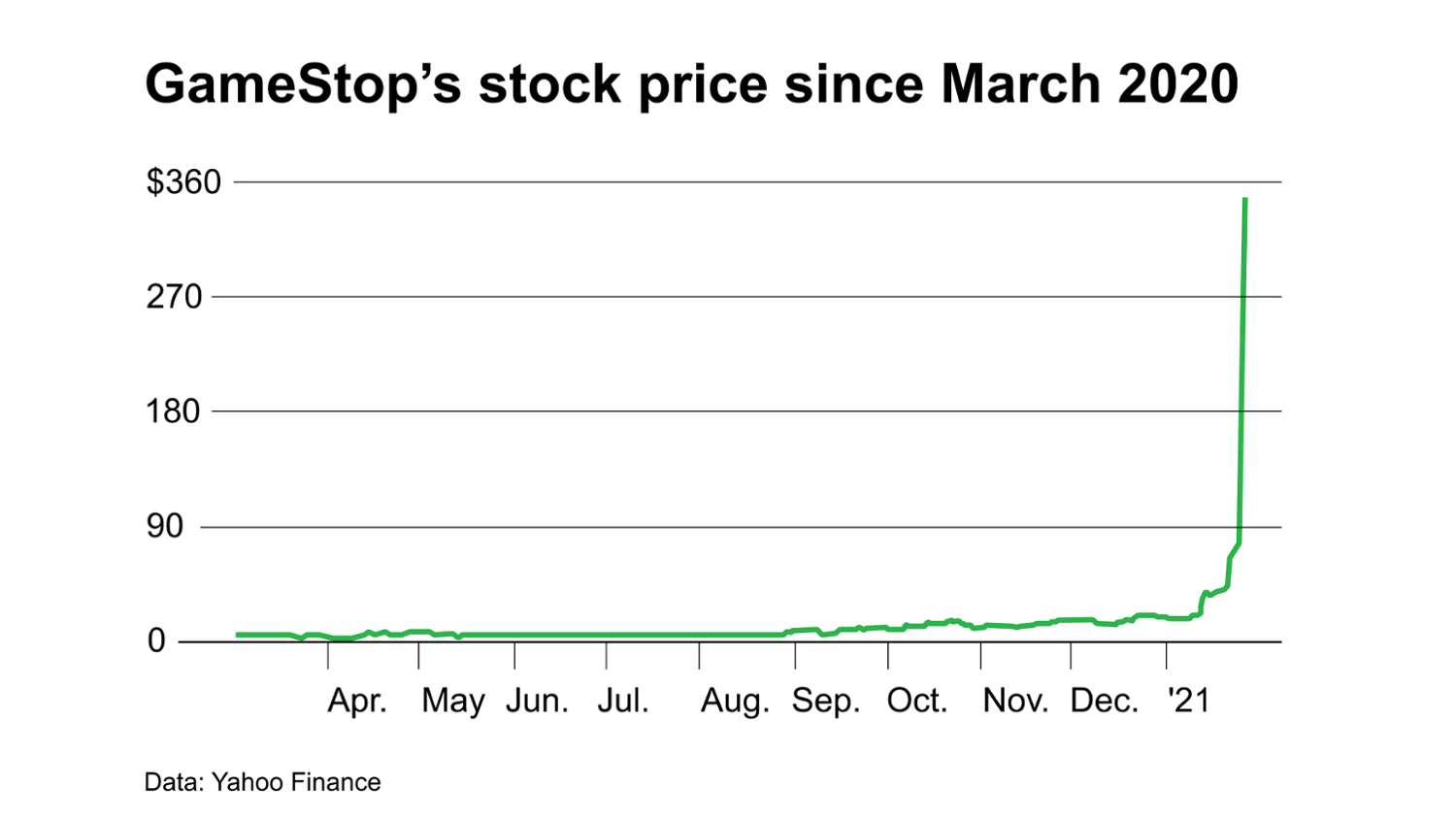

Stock markets, meanwhile, are subject to other external forces. We've all heard of the stock market roller coaster rides where stocks have soared and plunged in just a few moments – the not-too-distant Gamestop saga, where Reddit users utilized the power of social media to send the firm's share prices soaring by over 1,000% in just two weeks, is a prime example of that.

Both give us a thrill

According to a Stanford University study, people get a thrill from a rising stock in a similar way to a jackpot win: a strong feeling of adrenaline is involved in both. The study found that a part of the brain linked to excitement is involved in our financial decisions, so we enjoy both investing and gambling in a similar way.

A big return on our stake or investment generates extreme emotions which, for the thrillseekers among us, provides a lot of the attraction.

It also explains why issues such as problem gambling are so widespread, as the buzz we get is extremely addictive.

Both can be seen as a type of game

So, if we invest and gamble for fun, does that mean we can consider both to be a type of game?

Ami Shah, a wealth investor with a Harvard Business School MBA and over a decade of top-level investment experience, seems to think so. She says we should allocate a small amount of our wealth, maybe two or three percent, and use it as an 'entertainment budget' for investing. If we see investing as a game rather than a life-or-death situation, we're less likely to plough all our money into it.

This type of attitude, with a strict betting limit, is something that we would encourage in gambling, too.

Both are prone to cognitive biases

To add to the uncertainty and risk aspect of both phenomena, we also can't assume that we're always going to make logical decisions when dealing with external forces that influence our investment or gambling decisions.

Cognitive biases are an unavoidable part of the human psyche: deep-seated and influential, they cause us to behave in ways that loosen our control over logic.

They play a huge part in our gambling decisions and include concepts such as the Gambler's Fallacy – the belief that past events influence future outcomes – and Confirmation Bias, where we search for external data that backs up our belief system.

Investors are subject to similar thought patterns. Professor Robert Johnson PhD, is a successful investment author. In our interview, he cited economist Robert Shiller's argument that investors are driven by narratives surrounding the stock market that help to create bubbles.

One example is the 2008 US property market crash: investors were overconfident that nothing could go wrong in such a buoyant market – they based decisions on previous property prices (Gambler's Fallacy) or on skewed mortgage data that supported their hypotheses (Confirmation Bias).

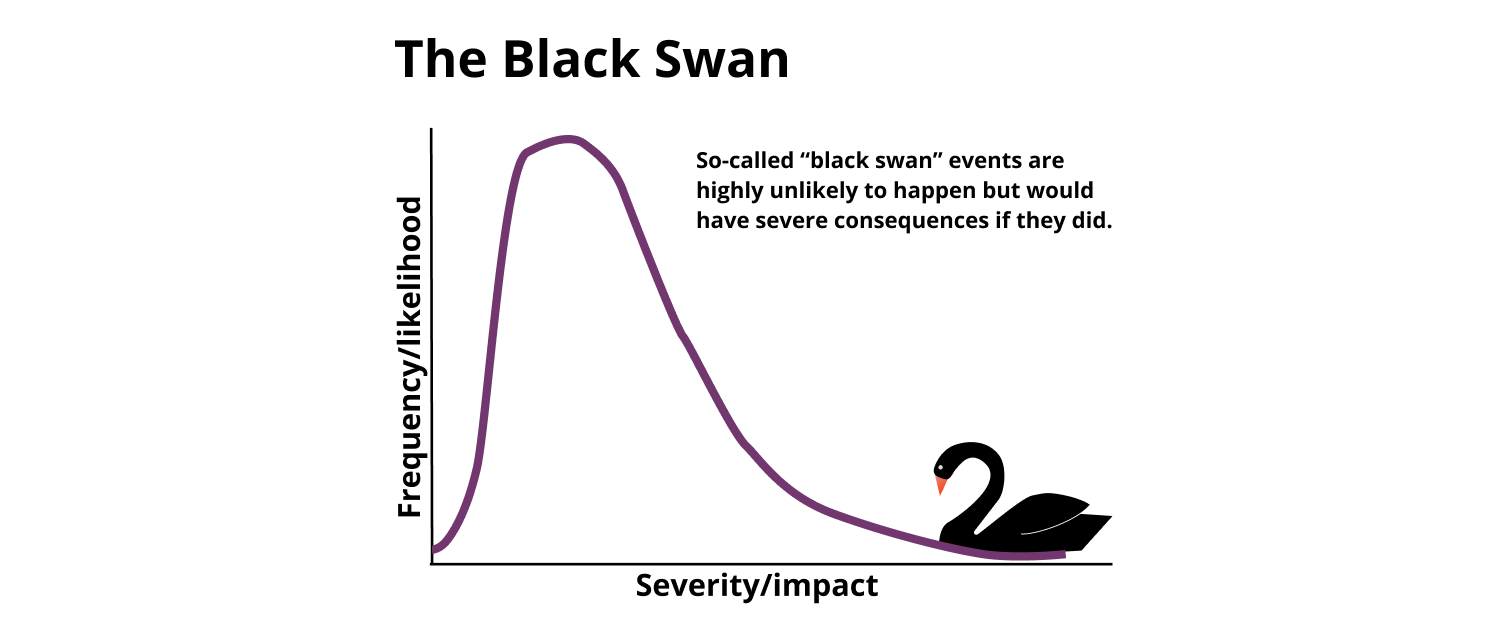

In other words, these investors were blind to the concept of black swans – highly improbable events that can't be predicted until they actually happen and, as a result, they drastically change the way the world works. The recent COVID-19 pandemic, World War II, The Great Depression, 9/11, and the war in Ukraine are all just a few examples of highly improbable but highly impactful black swans that investors constantly fail to account for when tailoring their dream investment plans.

As well as these biases, we may also respond to negative everyday emotions. Seeing your friend win at roulette or make profit on their shares may cause you to take the plunge the next time around (otherwise known as FOMO – fear of missing out); or an investment broker might tap into your greedy side and convince you to part with your money.

The bottom line is that we are wedded to our biases and emotions more than we think, whether we invest or gamble.

The key lies in recognizing these factors and taking action to minimize the effects of emotional thinking, thrill-seeking or simply chasing a quick profit. How well we do this depends on the control we can exert over each activity, and it's here that gambling and investing start to drift apart, and look decidedly different.

How investing and gambling are different

Now that we've learned what investing and gambling have in common, let's look at the other side of the coin.

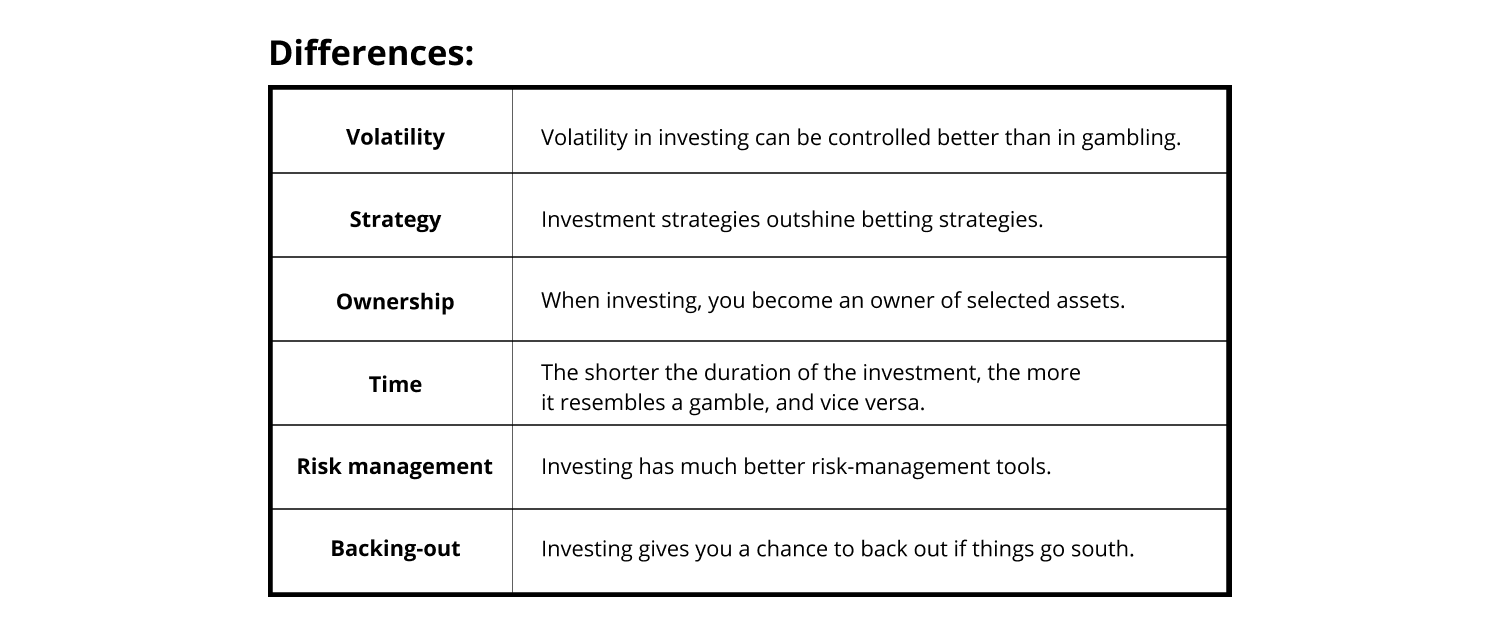

We can control volatility better in investing than gambling

Investing in stocks can be subject to volatility. Day trading is notorious for this and is the inspiration for those crazy Wolf of Wall Street scenes.

Professor Johnson identifies several prominent speculative devices that wise investors should avoid, such as CFDs, cryptocurrencies, NFTs, and the notorious leveraged ETFs and ETNs.

These are examples of 'speculating' — or making risky calls that have gambling tendencies — and putting your money at serious risk.

Johnson recommends sensible investments over a much longer time frame. Assets such as government bonds, real estate and precious metals might rise in value slowly, but they're also a lot more stable. Many of them also offer an underlying utility value, in that they would still be useful in the event of a financial crash: whether it's a house to live in, or precious metals that can be smelted into valuable objects.

In gambling, we can pick and choose our bets according to their risk – slot games offer varying levels of volatility, and we can choose ones with higher Return to Player (RTP) — but this offers nowhere near the level of control that a sensible investment does.

We would also go one step further than Professor Johnson by saying that even speculative trading is less risky than most types of gambling.

In casino games, as mentioned, however volatile a game is, the house edge means you will statistically lose a certain percentage over a period of playing.

This certainty doesn't exist in crypto or CFDs, where many people have ended up a lot richer over the course of many trades, and is the polar opposite of sensible investments that are sure to rise in value over time.

Investment strategies outshine betting strategies

We can't see into the future, so we're risking money every time we invest or gamble. However, looking at it in such simple terms ignores the skill of stock market professionals, like Warren Buffet, who assess the market and make consistent returns from knowledge-based decisions.

Investor Luke Smith is the founder of a successful real estate firm in the USA and one of the top-ranking professionals in his region. According to Luke, doing your 'due diligence' and studying an asset's risk factor is essential. An example is looking at its counterparty risk before investing – the chances of a stakeholder endangering the investment.

In real estate, due diligence is very specific and is done using detailed cash flow calculators, such as the one used by investor Brian Davis. On these, you plug in the expenses you're certain of, including property taxes and repair estimates, to get a clear idea of the return you can expect.

In contrast, gambling doesn't have anything on this scale. There are strategies out there for any game that might give you the best chance of winning, but these are restricted by the games' house edge, a mathematically guaranteed advantage in the casino's favor, that no strategy can defeat.

As experts in the gambling field, we cannot stress enough that you will always lose money in the long run, no matter if you gamble in land-based or online casinos.

Due diligence, on the other hand, allows us to make a very educated guess, especially on long-term investments, and makes it very likely that we make a profit over time: a much safer option than a betting strategy.

When investing, you become an owner of selected assets

When investing, you become an owner of a certain part of the business (or property, in case you invest in real estate) you're putting your money into. Being a shareholder in a company sometimes comes with additional benefits, such as the distribution of dividends.

However, you don't gain ownership of anything when you put your money into gambling. You simply just win or lose the money you stake.

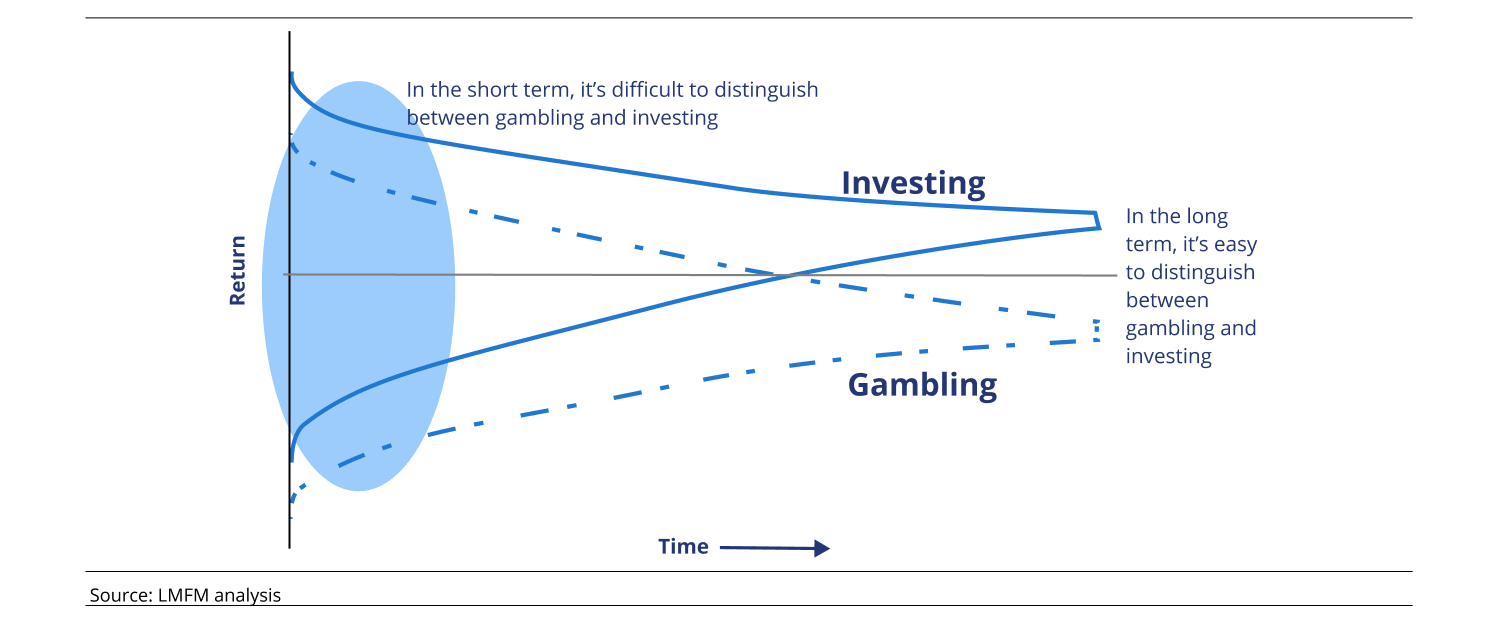

A matter of time

Whether you're investing in safer choices, such as the S&P 500 fund, or perhaps real estate, the longer you hold an investment, the more money you're generally expected to make.

However, the longer you gamble, the closer you get to the statistical advantage of the casino, which means that you will most certainly start losing money the longer you play.

The easiest way to see it is in terms of time span. In the long term, good investments are geared towards prudence and patience – like how you'd tend to a plant – while betting seeks immediate results. Long-term investments can bring dividends to our wallets. The shorter duration of the investment, then, the more it resembles a gamble.

As investment periods shorten, other factors come into play. We have less time to apply due diligence and risk-management tools: we enter the realms of cryptocurrencies and day trading where we try to make money fast; we're more susceptible to cognitive biases due to pressure; and we chase that thrill of a 'win', when we should use cold, rational logic.

Investment is a broad church, and we should always distinguish between its various types. By classing speculative trading as more of a gamble, something to make a 'quick buck', we're separating it from sensible long-term investments.

Making this distinction is important. If young people were educated about the dangers of quick profit-chasing, whether through day trading or gambling, we could avoid the financial crashes and gambling addiction that blight society today, and encourage a healthy long-term attitude to finance among future generations.

Investing has much better risk-management tools

As well as choosing the correct type of investment, traders also have an arsenal of effective risk-management tools at their disposal. Gamblers might argue that they also have methods that help them manage risk, so let's do a quick side-by-side comparison.

- Hedging is a way to counter the effect of a negative outcome by staking money on the opposite happening. You can do it in both activities, but investing has more elaborate methods, such as options and future contracts and offers way more security than bet hedging.

- Diversifying your portfolio and diversifying your bets are similar in concept: you spread the risk over several assets or bets so that you don't put all your eggs in one basket. However, a series of sports bets in different fields is still a lot riskier than spreading your investments over real estates, bonds and precious metals.

- You can insure some investments against loss, such as property and even precious metals, but good luck in finding someone who'll insure your gambling decisions.

To summarize, you can offset the risk of your investment assets, spread them over a wide range of industries and even insure them to protect yourself from financial harm. Gambling's tools are much less sophisticated and reduce risk far less than in investment.

Investing gives you a chance to back out if things go south

Connected with the stock market's volatility, it happens way too often: the quarterly earnings of a big S&P 500 company come in, the results don't match the expectations, and underperforming stocks go down – sometimes drastically. Investing gives you a chance to back out of an investment as it's going down, which allows you to save some of your investments by selling out before the stock reaches its lowest point.

This is a tricky situation, since the concept of panic selling is generally considered a big red flag among the investing community. Yes, you never actually know if the stock is going to bounce back or not, but investing gives you the chance to make an executive decision between two options: cash out and save some of your investments, or take the risk of possibly losing your investments and hope for a quick recovery.

We're sure many of the Gamestop investors that bought shares right before the crash were happy to be able to (hopefully) sell and save some of their money before the stock reached its lowest point.

Gambling, on the other hand, does not give you any "backing out" benefits. Once you put your money onto the imaginary table, there's no going back. The decision is finite: you either lose what you've staked, or the luck will be on your side. No in betweens.

Conclusion

So, while we tend to look at gambling and investing through the same lens, their fundamental differences are too large to put them in the same category.

Both can be considered a form of entertainment for many, but only investing is a reasonable way to gain profits. Gambling will statistically always put you in a disadvantage, which is why you shouldn't gamble with money you can't afford to lose. The best way to think of gambling is to see it as a form of entertainment you're paying for. You gamble for fun, but you invest for profits.

Remember: Investing can become gambling if done irresponsibly, but gambling can never become investing.